About the product/service

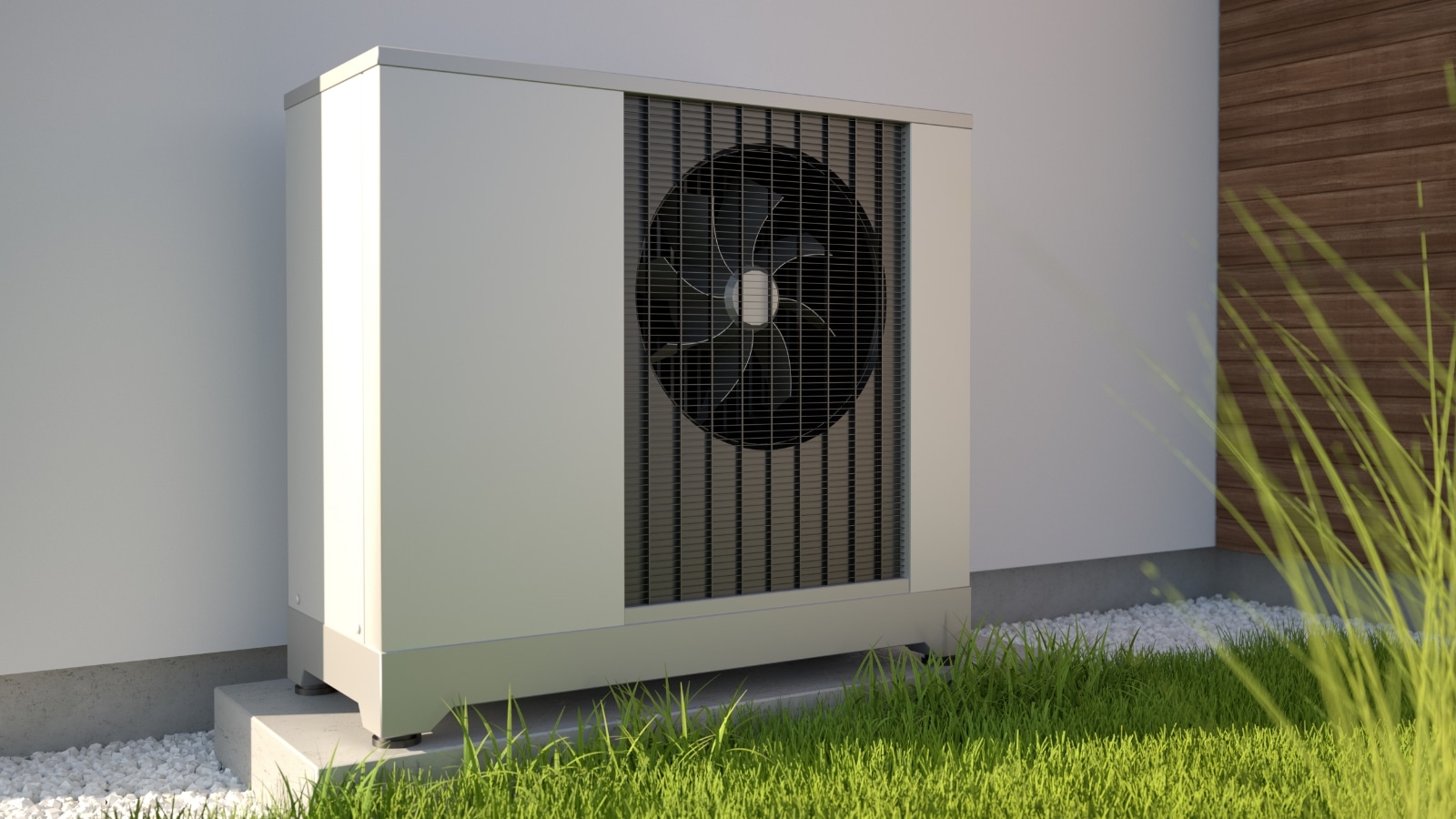

Our insurances compensate for the underperformance of heat pumps when certain weather conditions arise. The householder is compensated with a pre-specified payment per day (e.g., average cost/day to heat their home), for as long as the bad weather exists. Our claims process is seamless by using the heat pump sensors and weather data, without the need for any customer intervention.

Our insurances can also facilitate the purchase of heat pumps by guaranteeing part of the financing, as well as ensuring that the loan is fully repaid by automatically including a life guarantee.

These insurances are primarily protecting homeowners and SMEs but are aimed at improving the service being offered by the heat pump manufacturers and energy company retailers. This value chain makes the insurances surprisingly affordable.

This insurance product can be extended to every technology contributing to a lower-carbon footprint, such as solar panels.

Supporting greener outcomes

With government ministers even admitting that heat pumps don’t work as well as gas boilers, their adoption can be slow. Yet they reduce the average household CO2 emissions by around 3 tonnes a year and the average pump lasts around 25 years, which could mean a total saving of 70 tonnes. Our insurances will help scale the purchases of heat pumps in an economically feasible way.

By facilitating this transition for householders, there is an impact on the scale and on the environment. Having secured a scale demand, the manufacturer can then access better financing terms, which can be further improved by availing of green financing options.

Enabling customers today

We2Sure is working in collaboration with EPRI (Electrical Power Research Institute) in the United States to accelerate the replacement of fossil fuel water heating systems with low energy usage heat pump systems. We are currently implementing a bespoke insurance that compensates householders with a pre-specified daily amount for the underperformance of the system, as well as insurance protection for better financing options for social housing that guarantees inclusiveness for low-income communities.